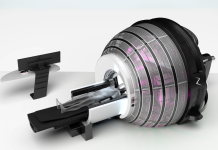

Outset Medical has announced a major $169 million private placement to advance its groundbreaking work in dialysis care. The funding, led by top institutional investors including T. Rowe Price and Perceptive Advisors, will support the company’s goal of reducing the cost and complexity of dialysis treatments. The deal includes the sale of Series A Non-Voting Convertible Preferred Stock, which, upon shareholder approval, will convert to common stock, bolstering Outset’s resources for continued product innovation and growth. This new capital is expected to help Outset achieve cash flow breakeven, ensuring the company can continue to scale its Tablo Hemodialysis System and improve patient care.

In addition to the private placement, Outset secured a $100 million term loan from Perceptive Advisors, with an option for $25 million more. This financing, combined with the repayment of existing debt, positions Outset with approximately $210 million in cash and investments, providing a strong financial foundation for the company’s continued expansion in the healthcare sector. With new funding in place, Outset is well-positioned to accelerate its mission of transforming dialysis delivery and enhancing healthcare efficiency across the globe.