Insulet Corporation has announced plans to offer $450 million in senior unsecured notes due 2033 in a private placement, subject to market conditions. The company intends to use the proceeds, along with cash on hand and potential funds from modifying its existing capped call transactions, to repay or repurchase its 0.375 percent Convertible Senior Notes due 2026. The funds may also cover accrued interest, associated fees, and general corporate expenses. Insulet has also disclosed plans to amend its existing Credit Agreement to extend the maturity of its revolving credit facility from 2028 to 2030 and increase the total available credit to $500 million. These amendments remain subject to market conditions and are not contingent on the completion of the Notes offering.

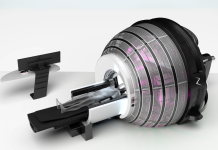

The proposed Notes have not been registered under the Securities Act or any state laws, meaning they can only be offered through private transactions. The company clarified that the press release does not constitute an offer to sell or repurchase securities. Insulet Corporation, based in Massachusetts, specializes in medical devices designed to simplify insulin delivery for individuals with diabetes. Its Omnipod system provides a tubeless, wearable solution that delivers continuous insulin for up to three days, eliminating the need for traditional injections.