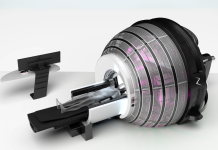

In order to overcome financial difficulties, Exactech, a world leader in medical technology, has reached an asset acquisition and restructuring support agreement with a number of its present investors. As the "stalking horse" bidder, this group of investors will purchase almost all of Exactech's assets and provide an extra $85 million to sustain continuing operations. The company's unsustainable obligations from previous knee and hip package recalls are intended to be released through the reorganization. Exactech will continue to provide top-notch orthopedic implants and surgical instruments, using this reorganization to improve its financial standing and deepen its dedication to patients and doctors.

Led by private equity firms with over $25 billion in combined assets, the investor group supports Exactech’s goals of advancing orthopedic innovation. The sale, subject to court approval, will be conducted through a voluntary reorganization process in the United States Bankruptcy Court for the District of Delaware. Exactech has filed motions to maintain regular operations, including paying employees and sales representatives and continuing R&D efforts. President and CEO Darin Johnson expressed confidence in the company’s trajectory, emphasizing that this reorganization will position Exactech for sustainable growth and long-term value for its stakeholders.