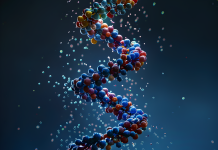

Eli Lilly and Company has announced a definitive agreement to acquire Verve Therapeutics, a Boston-based clinical-stage biotechnology firm developing gene editing therapies for cardiovascular disease. The acquisition, valued at up to $1.3 billion, includes a tender offer of $10.50 per share in cash and a contingent value right of up to $3.00 per share tied to future milestones. Verve’s lead candidate, VERVE-102, is a one-time gene editing treatment targeting the PCSK9 gene for patients with heterozygous familial hypercholesterolemia and atherosclerotic cardiovascular disease. It is currently being evaluated in a Phase 1b clinical trial and has received Fast Track designation from the U.S. FDA. Lilly expects the deal to close in the third quarter of 2025.

Ruth Gimeno, Lilly’s group Vice President, Diabetes and Metabolic R&D, stated, “Lilly is eager to welcome our Verve colleagues to Lilly and continue the development of these promising potential new medicines aimed at improving outcomes for patients with cardiovascular disease and addressing the significant unmet medical need in this space.” Verve CEO, MD, and Co-Founder Dr. Sekar Kathiresan said that the company aims to shift heart disease treatment to a one-time approach and believes Lilly will help accelerate that goal. He credited the team and trial participants for their progress and expressed optimism about the next phase under Lilly’s leadership.