Beta Bionics, a medical device company specializing in diabetes management solutions, has completed its upsized initial public offering, raising approximately $212.1 million in gross proceeds. The offering included 13.8 million shares of common stock, with 1.8 million additional shares purchased due to the full exercise of the underwriters’ option. The shares were priced at $17.00 each and began trading on the Nasdaq Global Market on January 30, 2025, under the ticker symbol “BBNX.” Notably, Beta Bionics did not receive proceeds from the sale of shares by the selling stockholders.

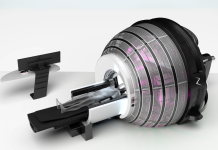

In addition to the IPO, Beta Bionics raised $17 million from a concurrent private placement of 1 million shares to an existing investor at the IPO price. The total gross proceeds, including both the IPO and private placement, amount to $229.1 million before deducting related expenses. The company is known for its innovative iLet Bionic Pancreas, the first FDA-cleared insulin delivery device that autonomously determines insulin doses, aiming to improve outcomes for individuals with insulin-dependent diabetes. BofA Securities, Piper Sandler, and Leerink Partners served as the lead bookrunners for the offering.